Nashville Downtown

Construction Financing Request

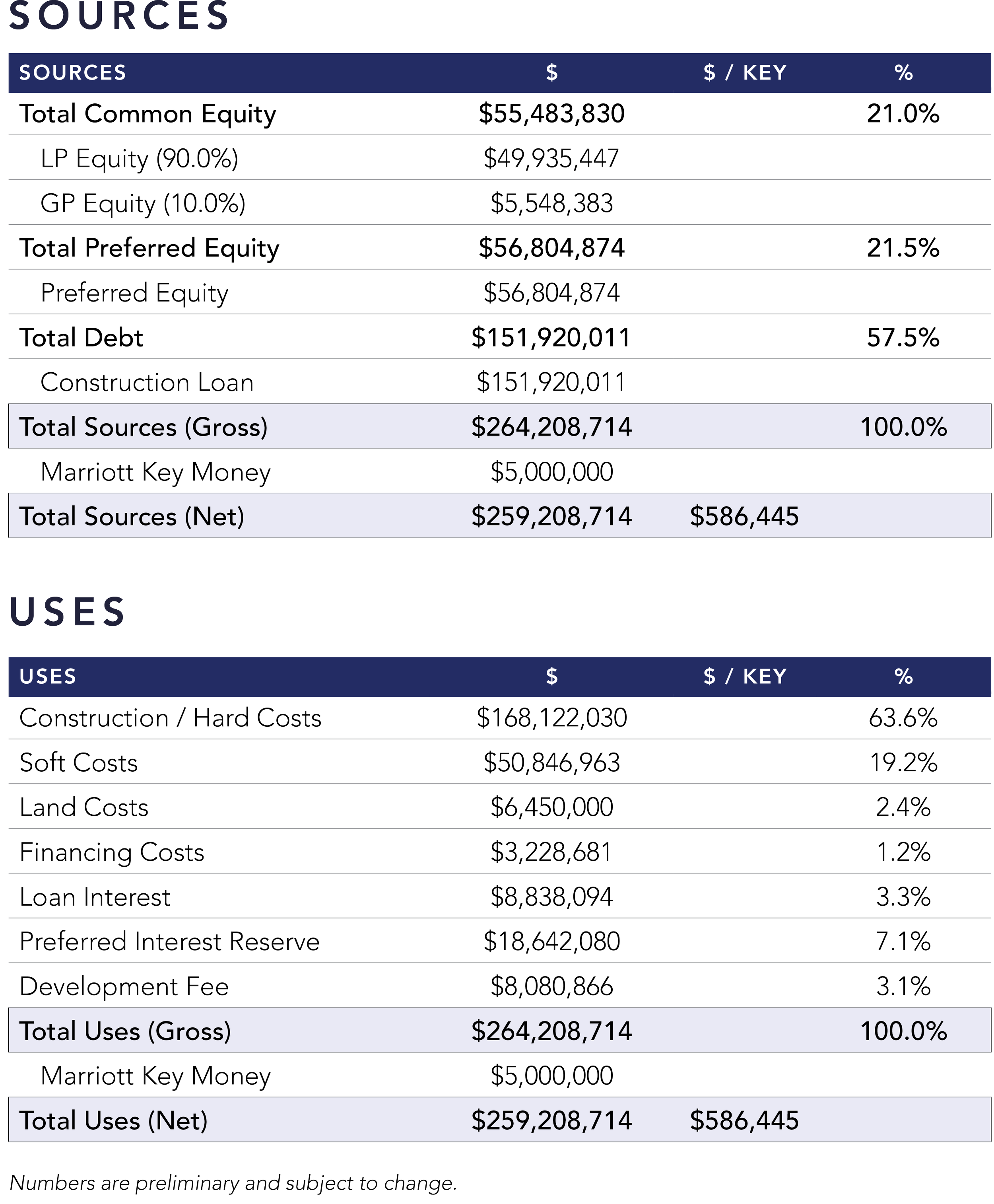

Hodges Ward Elliott has been exclusively engaged by Alamo Manhattan Acquisitions, LLC. (the "Sponsor") to obtain a 57.5% LTC or $152 million ($343,000 per key) floating rate loan at best available terms (the "Loan") to finance the construction of the leasehold interest in the to-be-developed Marriott Nashville Downtown (the "Property" or "Hotel").

The Hotel represents an exceptional opportunity to develop a best-in-class Marriott-branded property at an attractive basis in a prime downtown location within a premier hospitality investment market.

The Property’s A+ location places it within walking distance of Nashville’s top current and future demand generators including the Music City Center, Bridgestone Arena, Lower Broadway / Honky Tonk Row, Country Music Hall of Fame and Museum, Ryman Auditorium and Fifth + Broadway, as well as steps from one of the most dynamic mixed-use entertainment district developments in the U.S., Nashville Yards ($1 billion+). The Hotel’s design, accommodations and amenities will be best-in-class, with guest rooms averaging 402 SF, 24,381 SF of meeting space (including a 7,404-SF grand ballroom) and five food and beverage outlets with a variety of food and drink options ranging from a signature three-meal restaurant, to the expansive sixth floor outdoor pool bar, to the rooftop bar on the 21st floor that will offer breathtaking views of the Nashville skyline.

The Sponsor recently received Marriott International’s prestigious “Developer of the Year” award for the Marriott Dallas Uptown – an acclaimed new prototype property for Marriott’s iconic flagship brand, and one of the top performers in Dallas’ Uptown submarket. Importantly, the Hotel’s construction basis will be well below comparable full-service trades in the Nashville market. Furthermore, Marriott International is heavily invested in the success of this Property, as evidenced by its offering of $5 million in key money and three years of operating profit guarantees.

The loan request results in a stabilized (year three) debt yield of 18.0%.

Investment Highlights

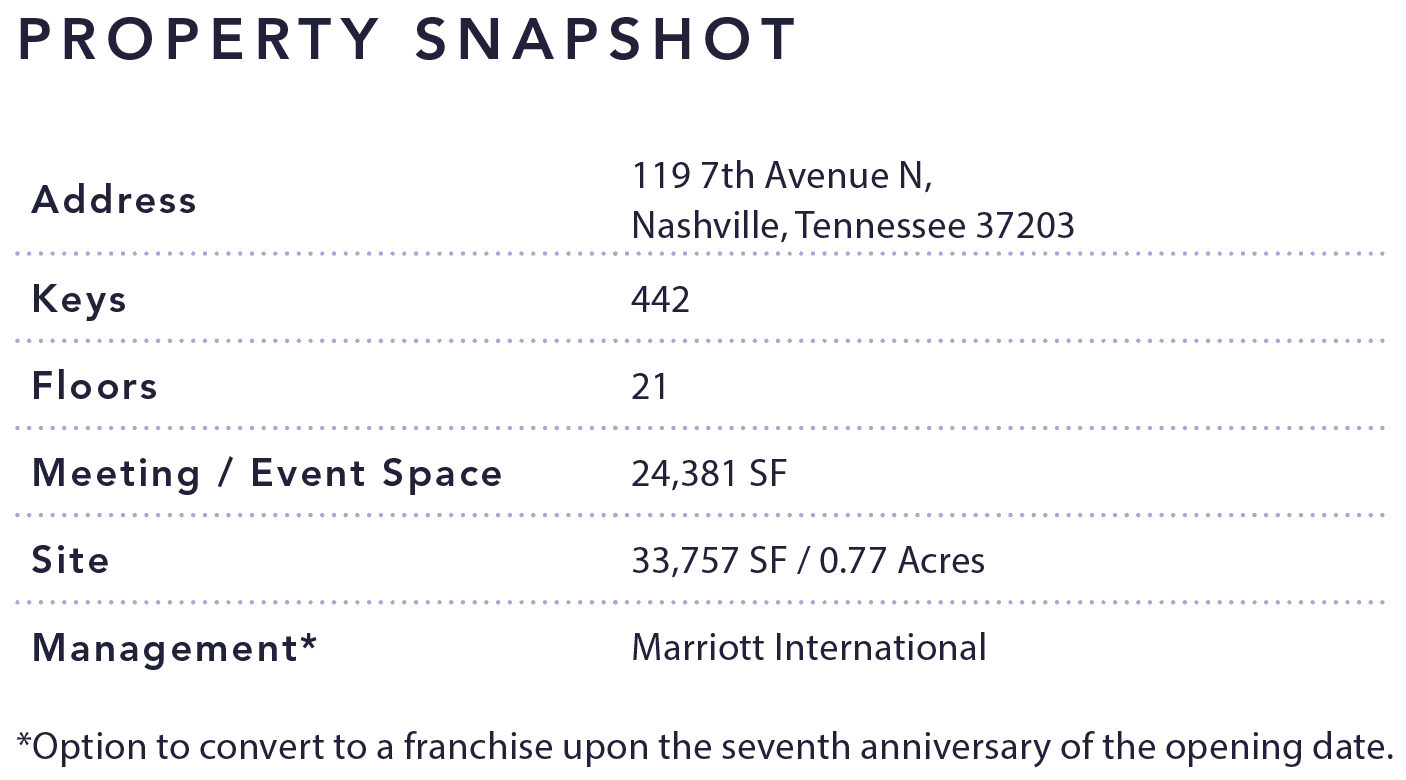

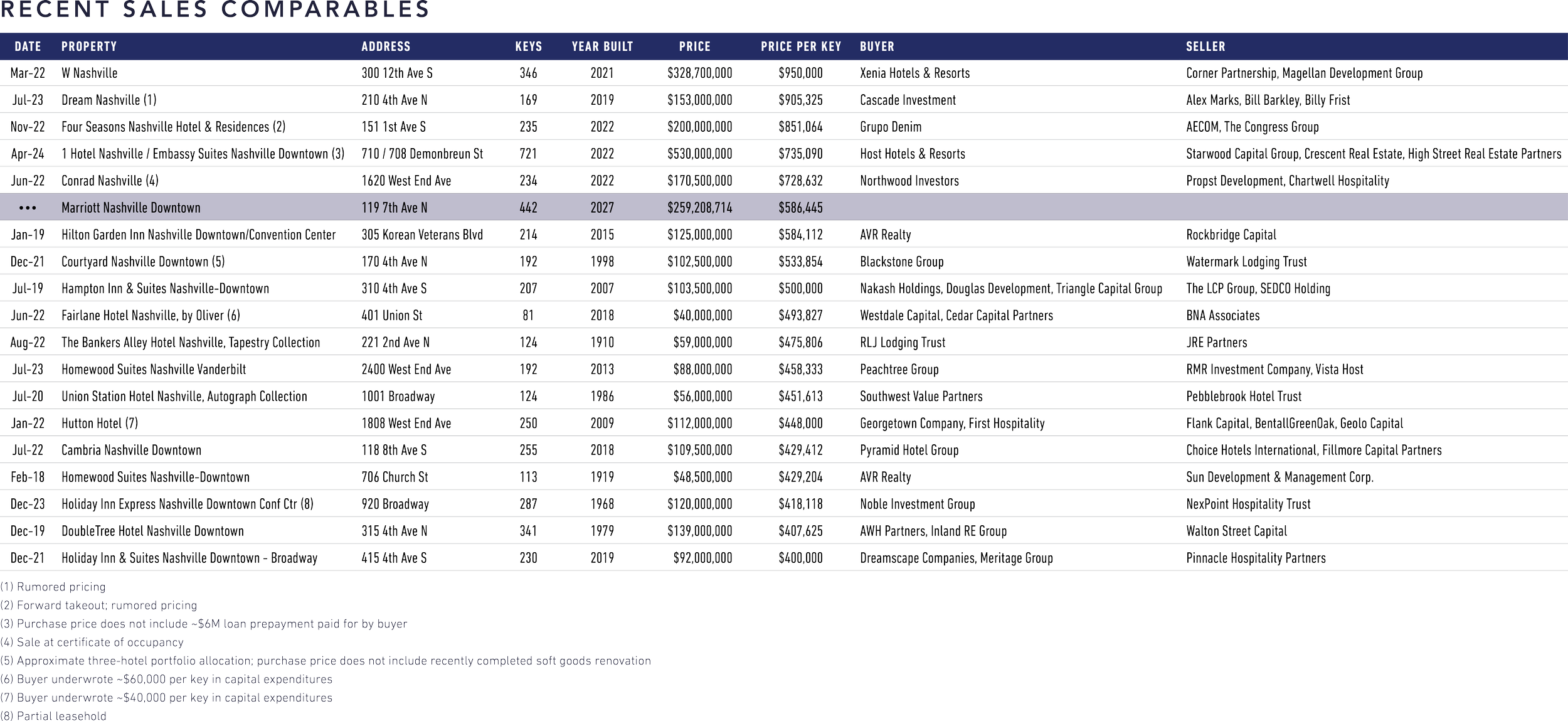

Decidedly Attractive Basis Supported by Sky-High Nashville Hotel Trades

Nashville’s hospitality sector has experienced tremendous real estate appreciation over the past decade, highlighted by numerous trades above $700,000 per key. These high valuations are evident across all lodging segments, with even upper-midscale and upscale hotels comfortably eclipsing $400,000 per key. Given the Marriott Nashville Downtown’s newness, irreplaceable location proximate to the city’s top current and future demand generators, best-in-class design, furnishings and programming, and industry-leading Marriott branding, the Property’s cost basis is well supported by an ever-climbing Nashville market precedent.

First-Class Design, Accommodations and Amenity Base

Designed and programmed by the best-in-class development team behind the immensely successful Marriott Dallas Uptown, the Property’s exceptional guest room and amenity package will position the Hotel to greatly outperform the market upon stabilization.

Averaging 402 SF, the Marriott will feature 442 oversized and expertly-designed guest rooms that will serve as the newest prototype for Marriott’s flagship brand.

The Hotel’s five food and beverage outlets further augment the guest experience, with a variety of food and drink options ranging from a signature three-meal restaurant, to the expansive sixth floor outdoor pool bar, to the rooftop bar on the 21st floor that will offer breathtaking views of the Nashville skyline.

In addition, the combined 24,381 SF of meeting space (including a 7,404-SF grand ballroom) will allow the Marriott to induce significant group room night demand and food and beverage revenue, in stark contrast to the majority of recent and future new supply, which are predominantly select-service or lifestyle hotels.

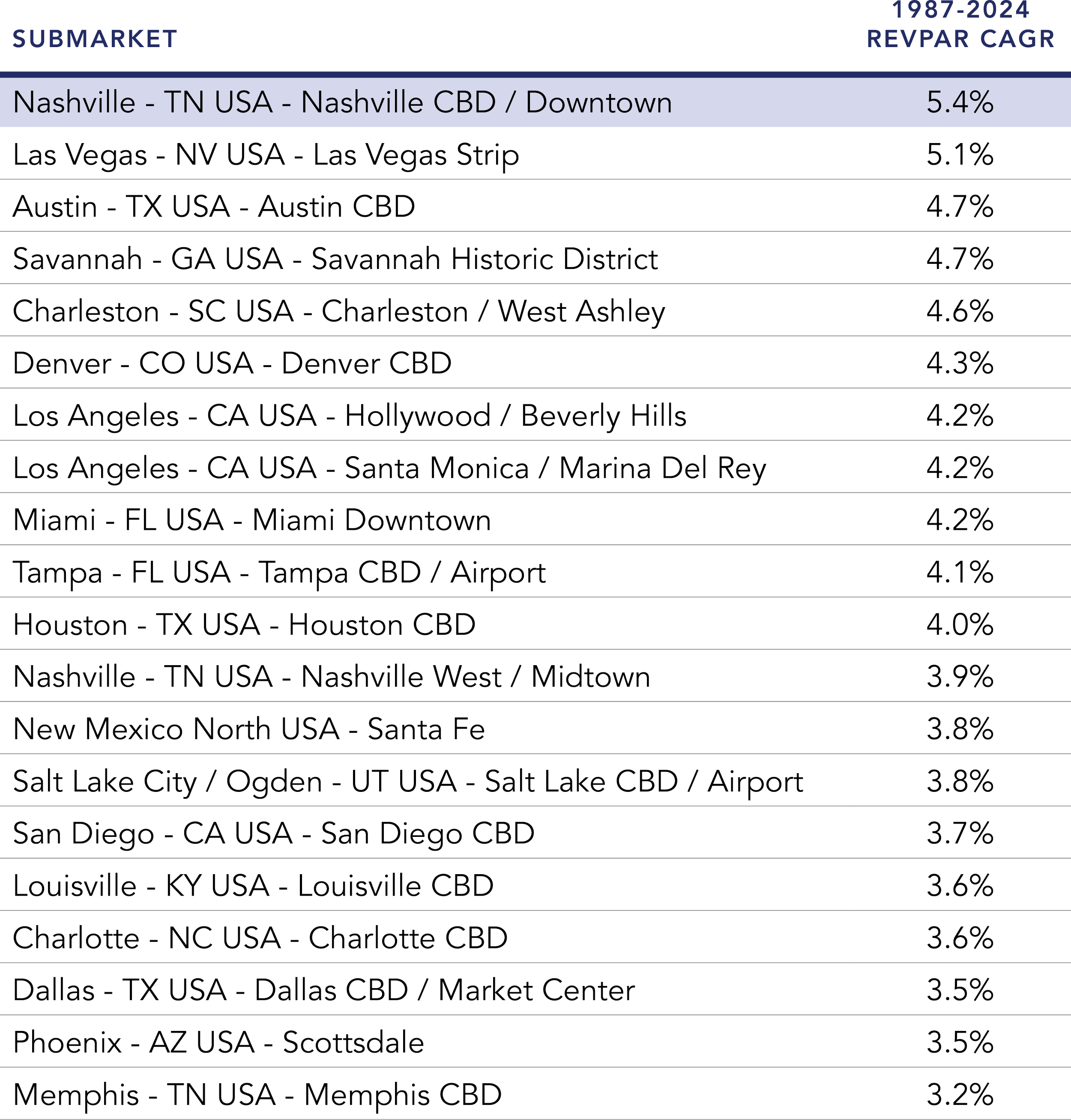

Highly Compelling Underwriting Substantiated by Relevant Market Comps

From a top-line perspective, the JW Marriott Nashville, given its size, programming, branding, amenity base, etc., serves as the best historical comp for the Property. In 2023, the JW Marriott achieved a $344.87 ADR and $289.69 RevPAR, respectively. The Property’s stabilized (2029F / Year Three) ADR and RevPAR of $397.75 and $318.20, respectively, equates to a miniscule 1.6% RevPAR CAGR from the JW Marriott’s baseline over the next six years – representing less than a third of Downtown Nashville’s 5.6% long-term RevPAR CAGR since 1987.

In terms of flow-through, the Marriott is projected to generate stabilized NOI of $61,948 per key (2029F / Year Three). In 2023, three of the Property’s closest full-service Marriott competitors – the JW, Renaissance and Sheraton – generated an average of $53,152 per key of NOI. Using that number as a baseline, it would require a mere 2.6% annual inflation rate over the next six years to hit the Marriott’s projections.

Furthermore, this robust cash flow translates to a highly attractive 18.0% debt yield in year three at requested proceeds.

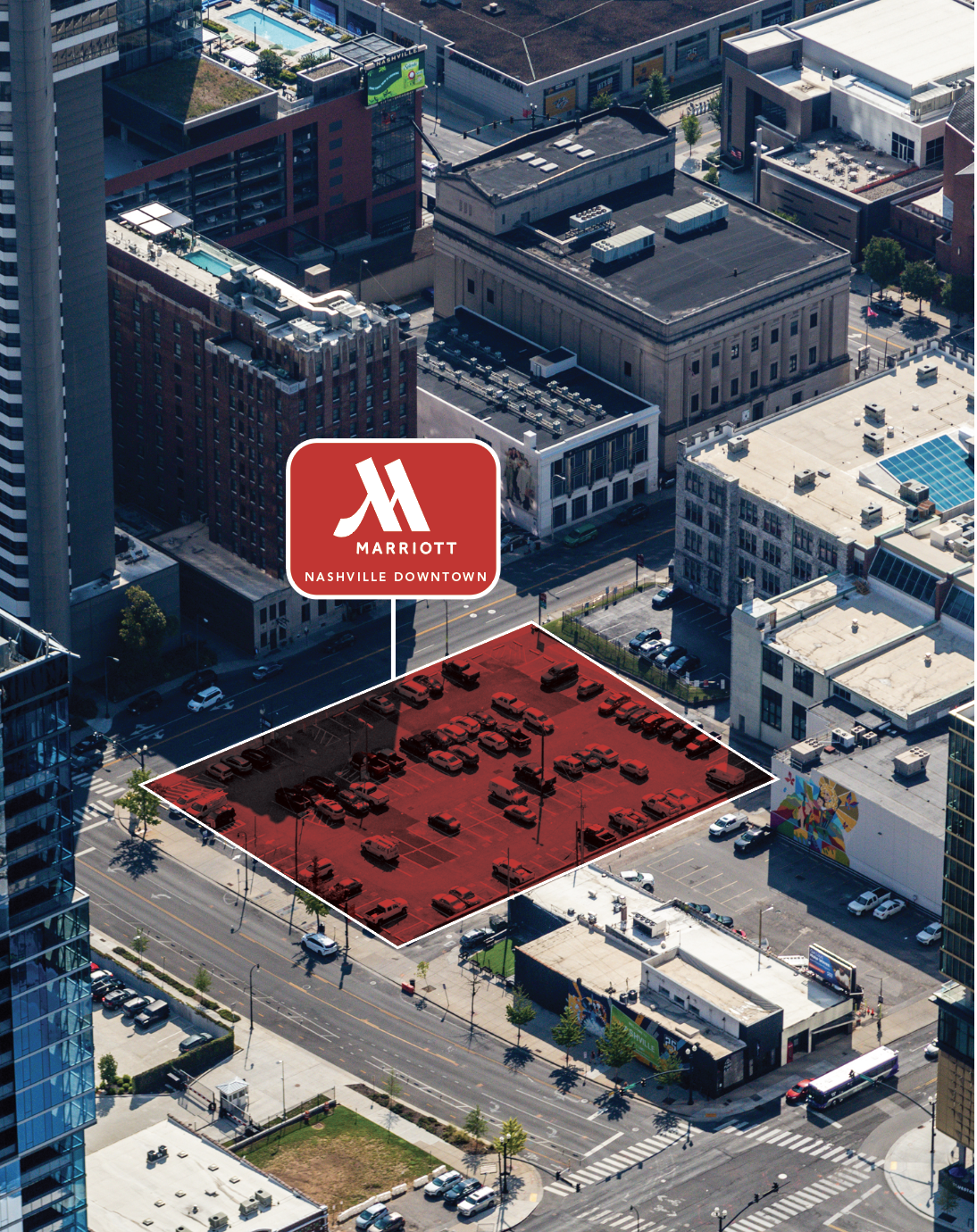

Irreplaceable Center-of-Gravity Downtown Location

Located in an A+ location at the epicenter of Nashville’s urban core, the Property is within a short walking distance of many of the city’s top demand generators, including Lower Broadway / Honky Tonk Row, Bridgestone Arena, Music City Center, Country Music Hall of Fame and Museum, Ryman Auditorium and Fifth + Broadway.

The Marriott is also less than a 10-minute drive from other prominent current and future demand generators including Nissan Stadium / New Nissan Stadium, Oracle’s future headquarters (8,500 employees) and Vanderbilt University, among others.

Moreover, the Hotel is one block from Nashville Yards – a 19-acre, game-changing mixed-use development spanning 3.0M SF of office space, 2,000 residential units, 350,000 SF of retail, food and beverage and entertainment space, a 4,500-person music venue and seven acres of green space. Still under construction, Nashville Yards’ tenant base includes Amazon’s Operations Center of Excellence (5,000 employees), PwC, Pinnacle Financial Partners, Bass, Berry & Sims, Creative Artists Agency and AEG Presents.

In terms of proximity to Nashville’s most significant current and future demand generators, there will not be another full-service hotel site that can replicate that of the Marriott Nashville Downtown.

Continued Downtown Nashville Lodging Market Outperformance

Downtown Nashville is the highest RevPAR urban market in the Sunbelt (T-12 January 2025 RevPAR of $214.36), and the highest RevPAR urban submarket in the U.S. outside of New York, Los Angeles or Boston.

Downtown Nashville has the fifth-highest long-term (1987-2024) RevPAR CAGR out of 633 comparable STR submarkets, and the highest long-term RevPAR CAGR of any urban submarket in the U.S.

Throughout the course of the post-pandemic recovery, Downtown Nashville has continued to outperform its urban and STR Top 25 Market competitors. This is particularly impressive when considering the massive multiyear wave of new supply that has delivered.

Looking ahead, however, Nashville’s supply pipeline has started to taper, as evidenced by the fact that there are currently no luxury or high-end hotels under construction – nor are there any Marriott-affiliated hotels of any kind under construction – in Downtown, Midtown or East Bank.

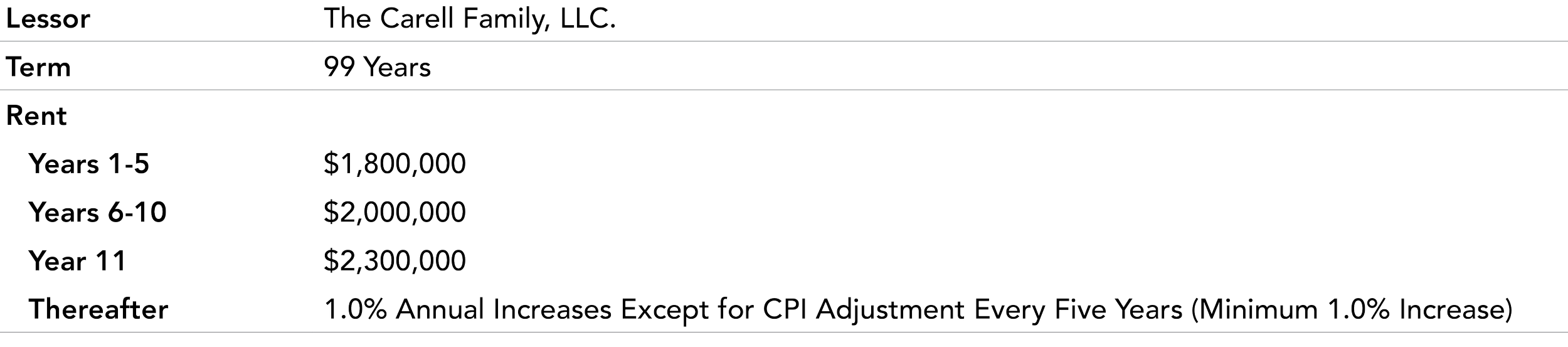

Favorable Ground Lease Terms

The Hotel is subject to a favorable 99-year ground lease with an established Nashville family that founded Central Parking Corp. and currently operates a parking lot on the site. The ground lease is fixed for the first 11 years, then subject to 1.0% annual increases with a CPI adjustment every 5 years.